What Happens to Debt when You Die?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you fretting about what happens to debt when you pass away? Let’s clear that worry.

Every month, more than 170,000 people visit our website for help with debt problems. We’re seasoned in helping you make sense of your debts and how to handle them.

This guide will explain:

- What happens to your debt when you pass away, including the 2023 laws.

- How to handle a loved one’s debt after their passing.

- Who is responsible for the debt of a person who has passed away.

- How your life insurance benefits might be affected by your debt.

- How to manage a debt that can’t be paid off completely.

We know dealing with debt can be tough. But remember, you’re not on your own. We’ll guide you through your choices and help you find a path that suits you.

Let’s get started!

Does Debt Die with You?

This question does not have a simple yes or no answer.

Sometimes with unsecured debts such as credit card debt, creditors do write off the debt, but they are not required to do so.

Use our free letter template to ask a creditor if they would write off the outstanding debt left after the death of a loved one.

In general, when someone dies, the debts that they leave behind become a liability on their estate.

When I refer to a deceased person’s “estate”, what I’m referring to is:

- Any money that they have in their bank account.

- Any valuable assets they have such as a car or jewellery.

- Any property that they own.

The executor or administrator of the estate is then responsible for paying off any outstanding debts. Keep in mind that they pay off these debts from the deceased person’s estate, they are not personally responsible for the debts.

All the money in the estate as well as other assets are utilised until all the debts are paid. If there is not enough money or assets in the estate to pay back the debts in their entirety, then they must be paid in a certain priority order.

This order is as follows:

- Secured debts, for example, mortgages.

- Priority debts, for example, council tax arrears and income tax arrears.

- Unsecured debts such as credit cards or unsecured loans.

Who is Responsible for the Debt of a Deceased Person?

Of course, this is one of the main sources of confusion when discussing the debt left behind when someone dies.

When it comes to credit card debt, the law states that only one person is allowed to be the primary cardholder. This means that only one person can be liable for the outstanding balance on a credit card.

Keep in mind that even if you’re an additional cardholder on a credit card, you will still not be liable for the outstanding balance on it.

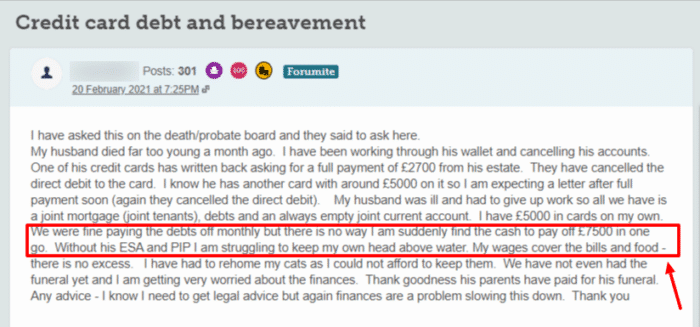

But if you are unsure, like the forum user above, you should contact a debt charity for some advice as soon as possible. They will be able to look at your finances with you in detail, and explain your best next steps.

That being said, there definitely are some cases which you definitely need to be aware of.

Firstly, as stated earlier, the estate of the deceased person will be used to pay off any debts that they left behind (including credit card debt).

If you jointly owned any property with the deceased person, you will have to clarify whether you were ‘joint tenants’ of the property or if you were ‘tenants in common’.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Joint Tenancy

If you and the person who passed away were joint tenants of a property, this means that both of you owned the property jointly (or equally).

In this case, when they passed away, the sole ownership of that property would be passed onto you. Creditors will not be allowed to force the sale of this property in order to pay off the debt that the deceased person owed to them.

Tenants in Common

Tenants in Common refers to having a share in a property. This means that you may have held 50% of a share in a property and the deceased person may have held a 50% share as well.

If this is the case with any property left behind by the deceased person, then creditors can definitely force the sale of this property in order to pay for the debt(s) owed to them.

Student Loans

If you die with any outstanding student loans from The Student Loans Company anywhere in the UK, your debts or outstanding debts are wiped out.

Someone will need to write to the SLC and explain, but no money will be taken from your estate.

Important Note for the Executor

If you are the executor of the estate, it’s a good idea to consider placing a deceased estates notice in your local newspaper. This is because you may not be aware of all of the outstanding debts that the deceased person may have left behind.

A notice in the local newspaper gives creditors the heads-up to step up and contact you in case the deceased person owed a debt to them.

It’s a good idea to do this before you start distributing the estate of the deceased person among creditors in order to pay off the debt.

This is because if you distribute the estate to all the creditors that you are aware of and then another comes forward, then you may be personally responsible for the debt. You may definitely be able to dispute this but it costs a lot of time and resources.

If you publish a deceased estate notice in the paper, it can help protect you from any liability for creditors that did not come forward.

How Do Debts of a Deceased Person Get Paid?

As mentioned throughout this post, the debts of a deceased person are paid off using the person’s estate which essentially encapsulates all of the money they had to their name as well as any assets they had. But how does this really happen?

Firstly, the funeral costs as well as any administrative costs for settling the estate can be paid using the person’s estate before attending to any outstanding debts.

Code of Conduct if You are the Executor

After this, a probate or grant of administration is put in place so that the executor (or administrator if no will was written) can start paying off the debts using the estate.

If you have been appointed executor, the first thing you should do is get legal advice. Dealing with someone else’s finances can quickly get complicated, especially after they have died, so getting legal advice is a quick and easy way to make sure that you are meeting all of your obligations.

It’s a good idea to quickly get a complete list of all the creditors the deceased person owed any debt to. As mentioned earlier, it’s a good idea to have a deceased estates notice in the local newspaper so you can track down any creditors you weren’t aware of.

Once all of the creditors are identified, it’s a good idea to contact all of them and inform them that the person has died. This will get them to back off and give you time as executor of the estate to decide how you’re going to distribute the person’s estate among their different creditors. At this point, all creditors should stop asking for payments and they should also stop taking any money they had been taking from any account of the deceased person in order to pay off their debt.

You should also ask the creditors for a letter or statement which details all of the outstanding debt that the deceased person has with them.

Once you have all of the details, you can start organising how you will distribute the assets and money among the creditors.

You have to distribute them in a certain priority order as I’ve stated earlier in this post.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Happens when All Debts are Paid Off?

Once you’ve paid off all of the outstanding debt, any money and/or assets that are left can then be distributed to the heirs stated in the will of the deceased person.

What Happens if All Debts Can’t be Paid Off Completely?

If the estate of the deceased person is exhausted and there is not enough money and/or assets left to pay off the debts in full, then an insolvency administration order may be carried out. What this essentially means is bankruptcy for a deceased person’s estate. At this stage, all outstanding debt is written off.

This includes all debts such as priority debts as well as non-priority debts like credit cards.

Can Creditors Take My Life Insurance Benefits from My Beneficiaries?

There are certain things your creditors are not allowed to take in order to pay off your debts after your death; This includes the benefits that your beneficiaries get from any life insurance policy that you may have taken out as well as money in your retirement bank account.

The proceeds from your life insurance policy go straight to your beneficiaries and are not considered to be a part of your estate.

That being said, it’s important to note that if your beneficiaries have debts of their own, then the life insurance benefits they receive will not be safe from their creditors.

Another important thing to keep in mind is that if the beneficiaries you have named in your life insurance policy are deceased as well, then the proceeds of the life insurance could be added to your estate. In that case, this money could be used to pay off your debt after you die.